A Lesson in Liability

Parents just received this mom is freaking out

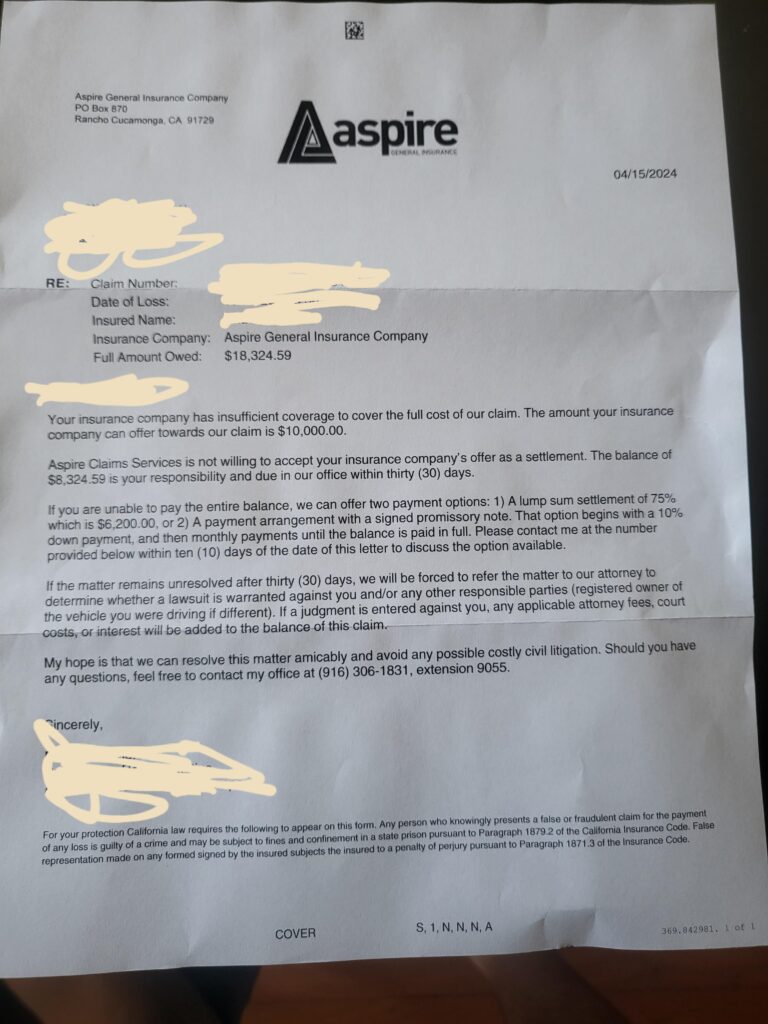

As parents, we often find ourselves navigating through various challenges, but nothing quite prepares us for the unexpected twists and turns that come with the territory of car accidents and insurance claims. Picture this scenario: a letter arrives, titled “Parents just received this, mom is freaking out.” The mere sight of such a title is enough to send shivers down the spine of any concerned parent. What could it possibly entail?

The contents of this letter outline a dilemma familiar to many: an insurance claim, liability limits, and the looming threat of legal action. The situation is not uncommon—a collision occurs, resulting in damages that exceed the coverage provided by the insurance policy. In this case, the coverage limit stands at a seemingly modest $10,000, leaving the parents vulnerable to potential financial strain.

Fortunately, the power of community and collective wisdom comes to the rescue, courtesy of insightful commentary shared on platforms like Reddit. Amidst the sea of advice and anecdotes, a common thread emerges: contact the insurance company. This simple yet crucial step serves as the first line of defense against the storm of uncertainty.

One commenter, well-versed in the intricacies of insurance claims, emphasizes the importance of leveraging the resources provided by the insurance company. They reassure that the insurance company’s duty is to protect its clients, offering legal representation and guidance in navigating the complexities of the claims process. In essence, the insurance company becomes the shield, shielding the insured from the daunting prospect of legal battles and exorbitant expenses.

Others chime in with practical suggestions, urging the parents to consider raising their policy limits—a proactive measure that could potentially avert future crises. The consensus is clear: insurance is not just a mere formality but a safeguard against unforeseen circumstances, a safety net that requires careful consideration and planning.

As the discussion unfolds, it becomes evident that behind every piece of advice lies a valuable lesson—a reminder of the importance of adequate coverage, prudent decision-making, and seeking assistance when needed. In a world where uncertainties abound, knowledge truly proves to be the greatest asset.

Imagine this: you receive a letter from someone claiming you owe a significant amount of money due to an accident. Panic sets in, leaving you wondering what to do next. This is the situation many parents found themselves in, according to a recent article titled “Parents just received this mom is freaking out.” Details are slim, but comments on a popular social media platform offer a glimpse into the confusion and valuable advice from people claiming expertise in insurance.

The comment section reveals a common thread: contact your insurance company first. Several users, who say they handle insurance claims, advise against speaking with anyone else. They emphasize that the insurance company has a duty to defend its policyholder, even if it means going to court. This can be a relief for those worried about expensive legal battles.

The discussion highlights the importance of understanding your policy limits. Commenters point out that the minimum coverage might not be enough in today’s world, urging readers to consider raising their limits and adding an umbrella policy. This can prevent a similar situation from turning into a financial nightmare.

One user’s experience sheds light on another approach. They detail how their insurance company was able to negotiate a settlement with the other party’s insurer, significantly reducing the amount owed. This highlights the importance of having a knowledgeable advocate on your side.

The social media thread also offers a cautionary tale. Some users warn against scare tactics. They suggest that the demand for payment might be an attempt to pressure the parents into paying more than they actually owe.

While the original article doesn’t reveal the outcome, the Reddit discussion provides a valuable resource for anyone facing a similar situation. The key takeaways? Stay calm, contact your insurance company, and understand your policy. By following these steps, you can ensure you get the help you need during a stressful time.

In the end, what emerges from this narrative is not just a tale of panic and apprehension but a testament to resilience and community support. It serves as a poignant reminder that in times of crisis, we are not alone—armed with knowledge and solidarity, we can weather any storm that comes our way. So, to all the parents out there facing similar challenges, take heart, for you are not alone in this journey.

Let this be a rallying cry to all: heed the advice, bolster your defenses, and remember that when it comes to insurance, preparation is key. After all, in the unpredictable journey of parenthood, a little foresight can go a long way.